- Our School

- Admissions

-

Academics

- Divisions and Faculty

- Commencement 2024

- January Term

- International Program (ESOL)

- College and Career Counseling

- Upward Bound

- Library/Monahan Academic Commons

- Career/Technical Education

- Lyndon Learning Collaborative

- Flexible Lyndon Institute Pathways (FLIP)

- Specialized Instruction

- Adult Continuing Education

- Lyndon Institute Course Catalog

- Student Services

- Arts

- Athletics

- Campus Life

- Support LI

- Alumni

« Back

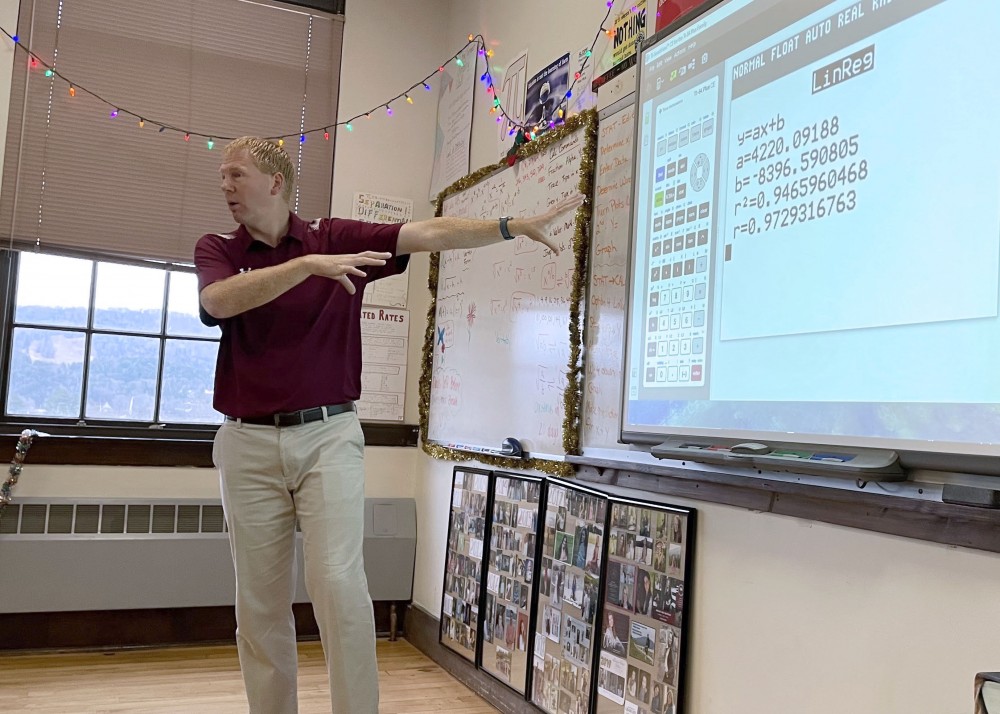

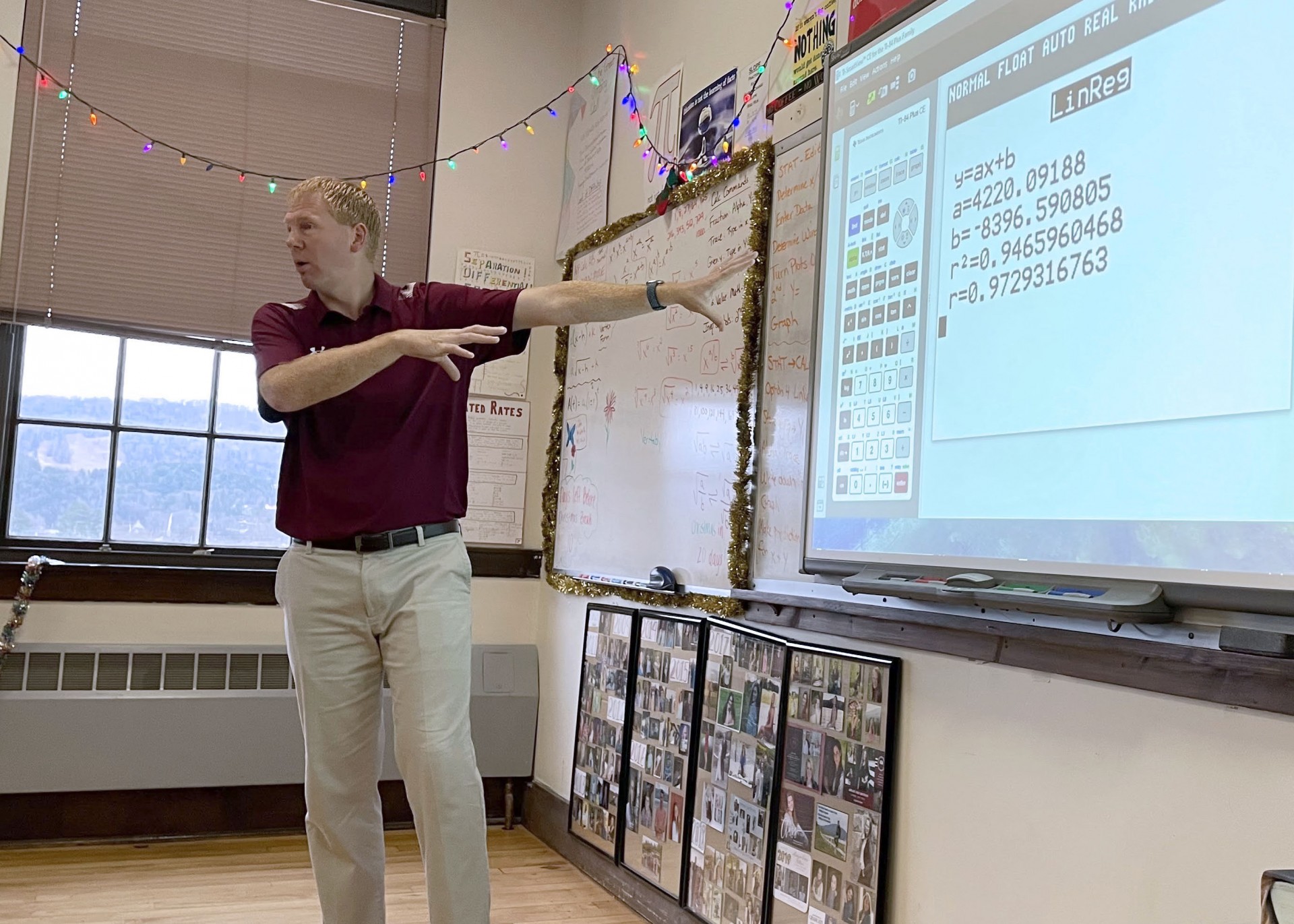

Modeling the Future

December 12th, 2022

By David Stahler Jr.

Lyndon Center, VT - “Let me tell you the story of a tall, spindly ginger,” Lyndon Institute math teacher Tim Ulrich tells his Algebra 2 Honors class. They all laugh. They know who the guy in the story is—he’s standing right in front of them.

“He’s a young man listening to his father tell him all about the importance of investing in his retirement. But the kid’s not really listening. He’s just nodding his head and thinking ‘Yeah, right. Whatever.’”

The story focuses on a mistake—a $250,000 mistake according to his calculations—in which Ulrich wastes ten years before finally beginning to invest in his retirement. As most of us learn, failure is one of life’s greatest teachers.

But the story has a happy ending—at age twenty-eight, Ulrich (now forty-four) does begin investing in his future, taking a multitude of paths, using a range of strategies that will help set him up for a comfortable retirement. Part of the happy ending hopefully lies in convincing his students that his cautionary tale will allow them to avoid the same mistakes Ulrich and so many of us make in putting off funding (or not funding at all) our retirement.

“It’s my favorite unit,” he tells me. In a course focused on mastering topics like factoring, quadratic equations, and logarithmic and exponential functions, Ulrich always takes a few days near the end to introduce financial planning to his students. “It fits in beautifully with the curriculum,” he says. Throughout the semester, with the help of their TI-84 graphing calculators, students practice making predictions, starting with linear modeling before moving on to quadratic, logarithmic, and exponential modeling.

“To take those skills and apply them to real-life scenarios is gratifying.”

While students do apply their skills, the actual mathematical portion of the two-day lesson won’t come until the end.

For now, Ulrich’s story ends in the present day, which is where things really get interesting as he begins sharing a sequence of charts and graphs of data taken directly off statements from his own personal accounts. He shares his Edwards Jones investment portfolio, his Roth IRA, his TIAA 401(k) retirement account, his Vermont State Teachers’ Retirement System account, his Social Security retirement account, even his wife’s IRA statement.

Along the way there is plenty of content-related language that the students at this point in the semester seem very familiar with (“the slope of the graph,” “linear growth,” “trendline”). But it’s the language they aren’t necessarily as familiar with that stands out as the discussion unfolds. The language of retirement, finance, and markets—“equities,” “bear and bull markets,” “defined benefit plans”—works its way into the lesson, coupled with more abstract concepts related to investing, such as the role of risk (“Everyone has a different level of comfort when it comes to taking risk”) and the importance of time (“Time is on your side if you invest early, otherwise you’re robbing your future self”) when it comes to making these decisions.

“Much of it comes down to our behavior,” he tells the class. “Saving is a habit. We talk a lot about bad habits, but we sometimes forget that repeated positive behaviors are habits, too. With a little discipline, we can establish these kinds of good habits.”

They discuss how much of one’s income a person should put toward retirement (answer: about ten percent) and how much income a typical person will ideally need in retirement in today’s dollars (about $1-2 million depending on factors such as how long a person lives, where a person lives, and what standard of living they want to have).

Seeing the dollar amounts of Ulrich’s retirement accounts listed over fifteen years in six month increments with the accompanying percentage increases catches the students’ eyes, but the biggest impact comes from seeing the data on a graph, noticing where the lines begin to make their exponential ascent after a long initial period of slower linear growth. The upward jump in Ulrich’s accounts is relatively recent, reinforcing his mantra about the importance of starting early.

“Imagine how this chart would look if I’d started ten years earlier?” he says.

Day two opens with a quick review. “Hopefully, yesterday got you thinking,” he says.

It has. Numerous hands shoot up with questions.

“What does it cost to have these accounts?” one student asks.

Ulrich laughs. “Fees!” he says. “That’s right, let’s talk about that.”

A few minutes later, another student asks, “Is there a cap to what you can contribute to your IRA?” The question leads to a good discussion about the difference between a regular IRA and a Roth IRA.

One girl raises her hand. “I was talking to my mom about all this. She said she didn’t have any extra money when she was young, and that it’s hard to put away for retirement when you’re living on a tight budget.”

Ulrich acknowledges the challenges that many people face when it comes to retirement savings. “But even small amounts can add up over time, especially when you start early,” he says.

A pair of dorm students from Spain, Clara and Yann, explain how retirement works in their native country. The day before, Ulrich had asked them to see if they could find out. “I talked to my mom last night,” Clara says. “We have pensions, but you have to pay taxes on them.” Yann adds, “In our region of Spain, how much you earn with your pension depends on what job you did and how useful it is,” which leads to a lively conversation about what people in his country consider ‘useful.’

Another girl says she called her grandparents living in Florida. “It was interesting hearing about it from them. They retired ten years ago and talked about the challenges of living on Social Security and what they’d saved.”

The discussion turns towards other forms of investments—commodities, real estate. “The goal is to get the students to realize there are multiple paths toward saving and investing,” Ulrich tells me.

The lesson culminates in a modeling activity. Ulrich leads them through the exercise as they enter thirty data points taken from his TIAA retirement account into their TI-84s and add a few variables before analyzing the resulting graph, which models predictions over an additional ten years. They study the different paths Ulrich’s accounts could take as the changes in function move from linear to exponential.

The exercise is a useful lesson in applied mathematics, but the larger lesson about life, time, and behavior is the one that matters most.

I later ask one of Ulrich’s students, Streeter Middleton, what she thought of the experience.

“I thought it was super helpful,” she says. “My parents thought it was good, too, that we were talking about it, since it was something they wished they had known when they were younger. People don’t talk about money very much,” she adds.

I ask if anything in the lesson surprised her. “Mostly how much you have to invest,” she said. “I had no idea a person might need to save so much.”

“I found the whole thing comforting, though, in the end. Just learning about it makes me feel better. Knowledge is power, right?”

Her classmate Jazmine Bogie agrees. “It’s what math classes need more of,” she says. “I like the real-world connection. It’s something you can take with you for the rest of your life.”

Ulrich, who also serves as the Math department chair, is pushing to expand this kind of learning. Next year the department will offer a full semester-long course called Personal Finance, which will cover a wide range of topics around developing financial literacy, including retirement, teaching students to master their financial security, both now and for the long term.

Lyndon Institute math teacher and department chair Tim Ulrich teaches courses focused on mastering topics like factoring, quadratic equations, and logarithmic and exponential functions. However, Ulrich always takes a few days near the end of the semester to introduce financial planning to his students, where they apply their math knowledge to this important real-world topic. Photo by David Stahler Jr., LI

Posted in the category Front Page.